Beyond the Contract: How Brampton Businesses Can Safely Hire Contractors in 2026

Book Consultation Book Consultation

11

FebBeyond the Contract: How Brampton Businesses Can Safely Hire Contractors in 2026

Introduction: The "Paper Shield" is Gone

For years, Brampton small business owners have relied on a simple strategy to hire help without the overhead of payroll taxes: print off an "Independent Contractor Agreement," have the worker sign it, and assume you are safe.

In 2026, that piece of paper is no longer a shield.

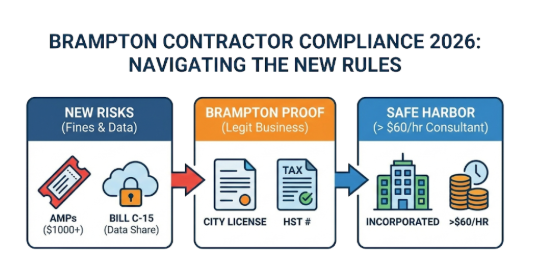

With the enforcement of Ontario's new Administrative Monetary Penalties (AMPs) effective January 1, 2026, and the aggressive data-sharing measures introduced by federal Bill C-15, the cost of getting it wrong has skyrocketed. The government is no longer waiting for a lawsuit to audit you; they are using real-time data to find "misclassified" employees.

If you are a logistics company in Bramalea hiring "owner-operators" who drive your trucks, or a tech startup in downtown Brampton hiring "freelance" developers who only work for you, you are in the crosshairs.

This guide outlines exactly how to navigate the 2026 legal minefield and legally hire contractors without triggering a devastating audit.

Part 1: The New 2026 "Teeth" (Why You Should Care)

The legal tests for "employee vs. contractor" haven't changed much, but the consequences have.

1. Immediate Fines (AMPs) As of January 1, 2026, Ontario inspectors under the Occupational Health and Safety Act (OHSA) and Employment Standards Act (ESA) can issue on-the-spot Administrative Monetary Penalties.

- The Change: Previously, the Ministry had to prosecute you in court to fine you. Now, an inspector can issue a fine (often starting at $1,000+ per worker) just like a parking ticket if they determine your "contractors" are actually employees denied safety training or basic rights.

2. The Federal Data Trap (Bill C-15) The federal government’s "Bill C-15" initiatives have bridged the gap between the CRA and Employment & Social Development Canada (ESDC).

- The Trigger: If your "contractor" is let go and applies for Employment Insurance (EI), this data is now instantly cross-referenced. If they were filing as a contractor but applying for EI (an employee benefit), it triggers an automatic audit of your business for unpaid CPP, EI, and taxes.

Part 2: The "Brampton Test" (Proving They Are a Business)

One of the strongest defenses in 2026 is ensuring your contractor looks, acts, and is licensed like a legitimate Brampton business.

1. The Municipal License Check Brampton has strict licensing for "Stationary" and "Mobile" businesses.

- The Strategy: If you hire a contractor for renovation, landscaping, or cleaning, require them to show you their City of Brampton Business Licence.

- Why it helps: A true employee doesn't have a business license. A true business does. If they can’t produce one, the CRA will argue they are just your employee.

2. The HST Number Defense Always require your contractors to invoice you with an HST Registration Number.

- The Trap: If they are "small suppliers" (under $30k) and don't charge HST, the risk increases. The CRA often views non-HST registrants as "disguised employees."

- The Rule: If they don't have an HST number, think twice.

Part 3: The "Business Consultant" Safe Harbor

For "white-collar" hiring (IT, marketing, management), Ontario offers a specific legislative safe harbor that many businesses miss.

The "IT/Business Consultant" Exemption You can legally opt out of the Employment Standards Act (ESA) if your worker meets specific criteria. This is the safest way to hire a high-level contractor in 2026.

The Checklist for Exemption:

- Incorporation: The worker must provide services through a corporation (e.g., "12345 Ontario Inc."), not as a sole proprietor.

- Written Agreement: The contract must explicitly state they are a consultant and state the rate of pay.

- The $60/Hour Rule: They must be paid at least $60 per hour (excluding bonuses/expenses).

If they meet these three tests, they are legally excluded from ESA protections (like severance and overtime), dramatically reducing your misclassification risk.

Part 4: The "Substance Over Form" Test (The ABCs)

If they don't fit the "Business Consultant" exemption (e.g., drivers, cleaners, general labor), you must pass the common law test. In 2026, adjudicators focus on three "killers":

1. The "Exclusivity" Killer

- Fatal Error: Your contract says, "You must work exclusively for [Your Company]."

- The Fix: Your contract must allow them to have other clients. Better yet, save proof that they do work for others (e.g., a website listing other projects).

2. The "Tools of the Trade" Killer

- Fatal Error: You provide the laptop, the truck, or the cleaning supplies.

- The Fix: The contractor must bring their own tools. If you are a trucking company, the "Owner-Operator" must genuinely own or lease their truck and pay for their own repairs. If you pay for the gas and repairs, they are an employee.

3. The "Profit & Loss" Killer (The Most Important Test)

- Fatal Error: The worker gets paid an hourly wage regardless of the outcome.

- The Fix: A true contractor has a chance of profit and a risk of loss. They should be paid a flat fee for a project. If they finish early, they profit (high hourly rate). If they screw up and have to re-do the work on their own time, they lose money.

Part 5: The "Dependent Contractor" Trap

There is a dangerous middle ground in Ontario called the Dependent Contractor.

These are workers who are technically contractors (they have their own tools/truck) but rely on you for 80-100% of their income.

- The Risk: You don't owe them CPP/EI, but you DO owe them "Reasonable Notice" (severance) if you fire them.

- 2026 Reality: Courts are now awarding Dependent Contractors up to 26 months of severance—the same as high-level employees.

- Mitigation: Limit the term of contracts. Do not let a "contractor" stay on for 10 years without a break. Encourage them to take other clients.

Conclusion: The 2026 Contractor Checklist

To protect your Brampton business this year, follow this strict protocol before the first invoice is paid:

- Check the License: Do they have a City of Brampton business license or valid HST number?

- Use the Exemption: For high-level pros, ensure they are Incorporated and paid >$60/hr.

- Audit Your Tools: Ensure they are using their own equipment.

- Kill Exclusivity: Remove any "exclusive service" clauses from your agreements.

- Get Insured: Require them to provide a "Certificate of Insurance" (CGL) showing they carry their own liability coverage. Employees don't buy liability insurance; businesses do.

Need a 2026-Compliant Contractor Agreement? Don't use a template from 2020. The rules have changed. Contact [Your Law Firm Name] to draft an agreement that protects you from the new fines and federal audits.

Disclaimer: This blog post provides general legal information for the 2026 Ontario business environment. It is not legal advice. Misclassification rules are fact-specific. Always consult a qualified employment lawyer.